Stamp Duty and Registration Charges in UP (Uttar Pradesh)

12 Apr 2021 Stamp& Registrations

By doing this one can ensure that the property is legally registered. In UP it is mandatory to register any property that is exceeding INR 100 in the sub-registrar office under Section 17 of the Uttar Pradesh Registration Act 1908.

Stamp duty is a legal tax that is payable during the purchase or sale of a property. The fee paid is used to register the property in the buyer’s name and legalize the property ownership. The stamp duty and registration charges in UP vary from other states. Generally, around 5-7% of the property’s market value is charged as stamp duty and around 1% is of the property’s market value is imposed as a registration charge in India.

The stamp duty charges imposed by the UP government is higher when compared to other states. Each locality has fixed circle rates which are imposed by the government. The property should be registered at a value equal to the circle rate or above it. The stamp duty and registration charges imposed by the UP government are:

Stamp Duty in UP 2021 and Registration Charges

|

Gender |

Stamp Duty Charges |

Registration Charges |

|

Male |

7% |

1% |

|

Female |

6% |

1% |

|

Joint (Male + Female) |

6.5% |

1% |

|

Joint (Female + Female) |

6% |

1% |

|

Joint (Male + Male) |

7% |

1% |

How to pay Stamp Duty online in UP

To ensure a seamless registration process the UP government introduced a digital platform. The homebuyer must upload all the documents required and pay the applicable stamp duty. The sub-registrar verifies the documents and issues the stamped certificate.

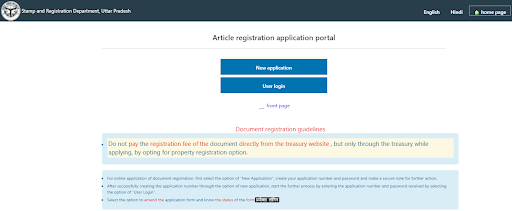

The stamp duty charges can be paid online by following the below-mentioned procedure –

-

Click on Apply for Registration and create an application number by selecting the New Application option

-

Click on User Login post creation of application number

-

Enter the details such as city, area, unit size of the property, etc.

-

Pay the stamp duty charges

-

The documents uploaded will be verified by the Sub Registrar Officer and the registration document will be generated.

-

The applicant can download the registration document

Reformation in stamp duty and registration charges in UP

The UP government notified new stamp duty rates on property registration fees in February 2020 and other transactions under which the maximum cap of INR 20,000 on the transaction was removed. The registration fee is calculated at 1% of the total transaction value. For example, if the property is registered at INR 1 crore that INR 1 lakhs will be levied as registration charges.

Due to the pandemic, the property sales was dipped, and hence the UP RERA (Real Estate Regulatory Authority) and NAREDCO (The National Real Estate Developers Council) requested the government to reduce the stamp duty and registration charges to encourage homebuyers to invest in real estate. The reduction would also help the developers to clear the unsold inventory.

The UP RERA requested for the change in stamp duty and registration charges post observing similar actions taken in states like Maharashtra and Karnataka to boost property sales. There is no action taken yet by the UP government on reducing stamp duty and registration fees.