Why real estate is still the most reliable investment in India?

12 Apr 2021 Hot Property Investments

Despite short-term challenges due to the Coronavirus pandemic and the presence of other investment avenues, the real estate sector remains one of the favourite instruments for a long-term investment in India.

The Coronavirus crisis was one of the most formidable challenges faced by the human race in a long time. Like every other sector of the economy, the real estate sector also faced hardships such as all-time low housing demand, negligible site visits, halted construction activities, and subdued confidence of homebuyers. However, after two spells of the pandemic, the real estate sector is resurgent and showing the green shoots of recovery.

Together with factors such as the unchanged Repo rate by the Reserve Bank of India (RBI), corrected property prices, and rising demand for personal spaces in the post-pandemic scenario, the realty sector has also ignited hopes of recovery for other ancillary sectors.

According to an estimate by the Ministry of Housing and Urban Affairs (MoHUA), India’s real estate sector is valued at USD 200-billion market in 2021 and will hit USD 1 trillion by 2030. Moreover, the real estate sector is the second largest employer after agriculture in India and contributes 7-8 percent to the Gross Domestic Product (GDP) growth of India.

Buyer’s market

Although the COVID-19 pandemic came as a sudden calamity, it led to a correction in the property prices and enabled the potential homebuyers to make an informed decision. With prolonged work-from-home arrangements and online education needs, rising demand for ready-to-move-in housing units was witnessed across the metros in the last one year. Be it a first-time homebuyer or an existing homeowner looking out for a larger space, the buyers want to go for ready-to-move-in and are wary of investing in under-construction properties.

Factors such as all-time low home loan interest rates, stamp duty cuts by some States such as Maharashtra, and attractive offers rolled out on ready units by several developers have also contributed to the recovering housing demand in India.

Indicating a further improvement in housing sales, the Financial Stability Report (FSR) of the Reserve Bank of India (RBI) has mentioned that the unsold residential property levels have reduced to about 7 lakh units in March 2021, as compared to 8.50 lakh units in the first quarter of 2020. The opinion is also seconded by the real estate research report by Anarock that the sales momentum in the top seven metros has increased by 93 percent annually.

Long term growth outlook

One of the major reasons behind the investors' affinity towards the property market is that it is only the value of a building that depreciates, while that of a land parcel appreciates at a much higher pace. If investors have surplus money, they would like to buy a piece of land than investing in a Fixed Deposit with meagre returns. Moreover, growing investment in the real estate sector is also augmenting the hopes of good price appreciation.

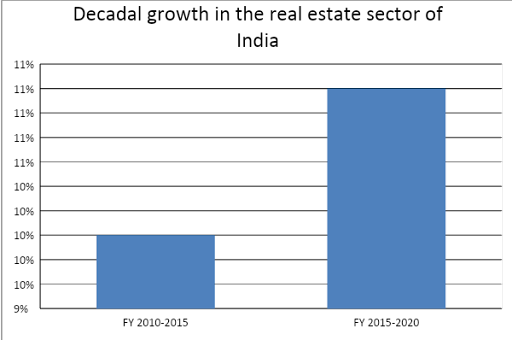

If historical data is referred to, it can be observed that the real estate sector grew by 11.2 percent from the fiscal year 2005 to 2020.

Decadal growth of the real estate sector of India

(Source: India Brand Equity Foundation)

Unlike other market-linked investment options such as stocks and mutual funds, investment in real estate comes with a low volatility quotient. Being a tangible asset, it is still one of the safest investment options in India.

Passive income and collateral

An important motive of real estate investors is to earn passive rental income from the property investment. The rental income, however, varies according to city, location, demand, and property type. Generally, commercial properties have a higher rental yield than residential properties. Top metro cities such as Mumbai, Delhi, Bangalore, Hyderabad, and Kolkata provide ample opportunities to earn rental income from student housings, commercial leases, and farm leases.

In addition to this, a property is considered more than an investment option in India and has an emotional value attached to it. Besides the growth and passive income opportunities, one can always pledge a property with the bank as collateral and raise a loan against property such as a business loan, education loan, etc. without much hassle.

Low home loan interest rates

At present, home loan interest rates in India are at a 15-year low level. Most of the banks and Housing Finance Companies (HFCs) are offering home loans at interest rates below 7 % annually. With available tax benefits on home loan repayment for eligible customers, the effective rate of interest turns out to be lower than 5 % per annum.

On top of it, if a person avails of an overdraft facility or raises a top-up on the home loan, he gets an additional credit line at the same or 1 % above the home loan rate. Thus, the applicant can enjoy extended liquidity and cheaper credit for urgent cash needs along with the housing loan.

A home loan is one of the most affordable bank loans in India. With 6 % or higher inflation, long-term investment in a property is certainly a wise use of lump sum money. Interestingly, one can avail of a home loan up to 75-85 % of the value of the property.

Tax saving with housing loan

A homebuyer can save tax on repayment of home loan principal as well as interest amount. For joint home loan applications, each applicant can claim a deduction as per the available limit. As per Income Tax (IT) Act, an applicant can claim deduction up to Rs 1.5 Lakh under Section 80 C on principal repayment and up to Rs 2 Lakh under Section 24.

The tax saving is as per the income tax slab rate. Under Section 80EE, for affordable housing units up to Rs 50 lakhs, an additional deduction of Rs 50,000 can be claimed on interest repayment up to Rs 35 lakhs or less.

An oversight of RERA

With the implementation of the Real Estate (Regulation and Development) (Act (RERA), the interests of home buyers are well protected. The RERA has also boosted investors’ confidence in the realty sector. RERA makes it mandatory for builders to share project details in a public notice and a project is considered invalid if the developer does not have a RERA registration number.

The builders are required to update project progress or delays periodically. Thus, the RERA has enhanced accountability and transparency in the real estate sector.

Conclusively, there is no ‘one size fits all’ investment opportunity. The investor must judge investment horizon and risk appetite before making a decision. Do the maths and use professional advice. One can also make use of property portals such as Magicbricks.com to keep a tab on prices and make an informed investment decision.